Travel After COVID-19: Where Are We Heading?

The coronavirus outbreak has had, and continues to have, a tremendous impact on the development of the travel industry. As governments close borders and travelers cancel their trips, many companies in this niche are downsizing and even shutting down. So, what exactly is going on in the travel niche?

Aviation

Airlines are suffering major losses, as travel came to a standstill in much of the world with 93% of the population living in countries with travel restrictions due to the COVID-19 outbreak.

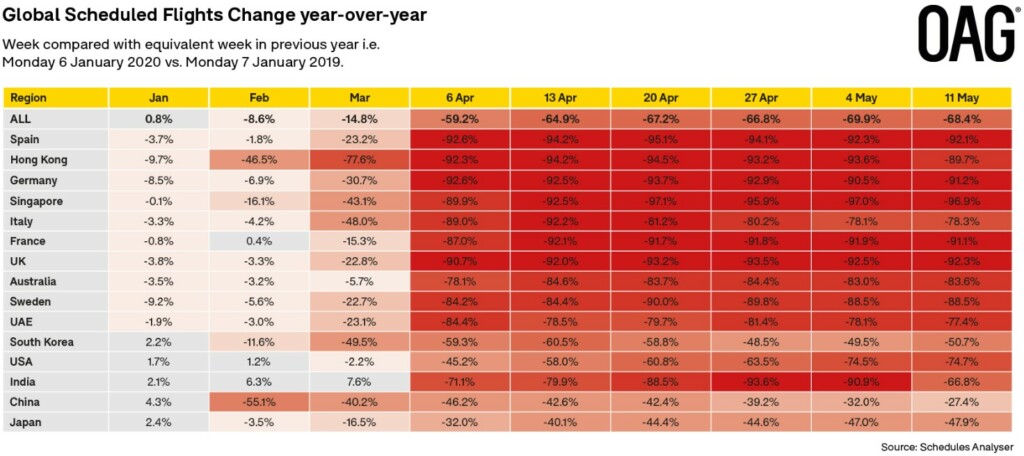

Scheduled flights are down by 70%, compared to the same week last year, apart from cargo-only flights. Aviation took the largest hit in Singapore, Hong Kong, UK, Spain, France, Germany, Sweden, and India (around 90% flight cancellation rate).

Naturally, this has implications for air carriers. Many of them are downsizing or laying off crew for several months. Some carriers, such as Delta, are experiencing 90% revenue losses compared to last year.

Due to health concerns, airlines are introducing changes to the way they operate their services. On Lufthansa flights, middle seats are left empty for the purpose of social distancing, and EasyJet is planning to do the same as soon as it restarts flights. Delta provides crews with a 19-point cleanliness checklist for cabin disinfection and is installing air-circulation systems with air filters into its aircrafts.

Hospitality

Changes in the hotel industry is undergoing are different for each region. For example, hotel occupancy rates hit rock bottom in Italy (4% in Milan and 6.6% in Rome), while other European countries faced an average drop in occupancy rates of 61.6% to 26.3%, compared to 70% to 100% under normal conditions. The highest rates were witnessed in Sydney (48.5%) and Los Angeles (42.5%).

To withstand this challenge, hotels felt compelled to temporarily close their properties. For example, IHG closed 10% of its hotels in the United States and 50% of its portfolio in Europe, Asia (excluding China), the Middle East, and Africa. Marriott temporarily shut down 25% of its properties. However, on a global scale, the picture is rather optimistic, as only 2% of the global hotel supply has been closed, according to Bernstein research.

Hotels are introducing new hygiene regimes to assuage the concerns of guests. For example, Hilton announced plans to implement its own cleaning standards, while Marriott is developing hospital-grade electrostatic sprayers.

Authorities throughout the world are trying to provide the niche with assistance. The UK government granted access to loans worth over $407 million. France provided corporate income tax deferrals, while China granted travel vouchers and aid so that hotels can provide special rates and attract more guests.

When will the industry recover: Expert forecasts

As the COVID-19 pandemic is entering a downturn in some regions, such as China, many experts are starting to share their forecasts on the future of the travel industry.

In general, they are unanimously optimistic about the niche’s inevitable rebound. “The travel and hospitality industry has weathered many catastrophic events, such as 9/11 and the Great Recession, and, in every circumstance, travel always climbed back and flourished,” said Sooho Choi from Publicis Sapient.

The question is how long this recovery will take. The Foreign Ministry of Germany expressed confidence that global travel won’t resume until June 14.

Alexandre de Juniac, director-general of the International Air Transport Association, believes that travel restrictions will be maintained at least until the middle of the year, if not until year-end. He also estimates that countries with a lower coronavirus case count will open domestic routes first, along with short-haul flights, while global travel will restart later.

Gary Bowerman, a tourism and consumer analyst, believes Australia and New Zealand will move first, as both countries are remote and have similar situations at the moment. The Asia-Pacific region can also be one of the first sections to open up, as the pandemic subsides in that area. The bubble approach is already being implemented in the Baltic countries, while the European Union insists on lifting travel curbs for all its member countries simultaneously.

Most industry representatives agree that the opening will happen in phases. Chip Rogers, CEO of the American Hotel and Lodging Association, believes that the rebound will be gradual, beginning with individual leisure, followed by business and group bookings.

An IATA survey shows that about half of the travelers interviewed will wait two months before flying again, 28% of those polled will wait six months, and only 14% will fly right after the travel restrictions are lifted.

Other travel sectors will recover at their own pace, as they are confronting different challenges. Thus, United Airlines expects “demand to remain suppressed for the remainder of 2020 and likely into next year,” while Delta estimates that it might take up to three years for the business to regain the lost ground. In general, executives believe that planes will be able to fly at full capacity no earlier than one year, as travelers will remain cautious after the pandemic is over.

Chip Rogers from the American Hotel and Lodging Association expects the U.S. hotel industry to return to 70% of its former level in one year, but there will be fewer rooms and staff members. He also believes that hotels will open the moment they are allowed to. Bjorn Hanson believes that room rates will remain relatively cheap and there will be discount offers galore for months or even years to come.

While some researchers think that travelers will find it dangerous to stay at someone else’s residence and prefer hotels with increased sanitation standards, others expect an increased demand in vacation rentals and private accommodations.

The cruise niche, no stranger to incidents and shutdowns, is betting on the loyalty and flexibility of customers. Virginia Sheridan, managing partner at North America Travel, expects cruise lines to merge and even sell off ships, but not disappear. Though many bookings have been cancelled for 2020, the number of cruise reservations for 2021 is already higher than in 2019.

Moreover, ships can be moved to regions that are recovering faster than others and new itineraries can be created. Paul Hackwell from TPG Capital says it typically takes one year for the industry to return to normal, but a multiyear bounce back is still possible in this case.

Emerging Trends

Travelers are shifting to private properties instead of crowded hotels and resorts. Many prefer driving to flying and have returned to using travel advisors and trip insurance. As the industry is relentlessly transforming, businesses need to follow emerging trends to stay afloat.

1. Domestic and Regional Travel

Forced to stay within the borders of their own countries, travelers will start exploring their surrounding regions and cities. As soon as it’s more or less safe to leave the house, people will want to make up for the downtime and look for domestic travel opportunities. For example, go on road trips, visit family, escape the town by travelling to the countryside, and so on.

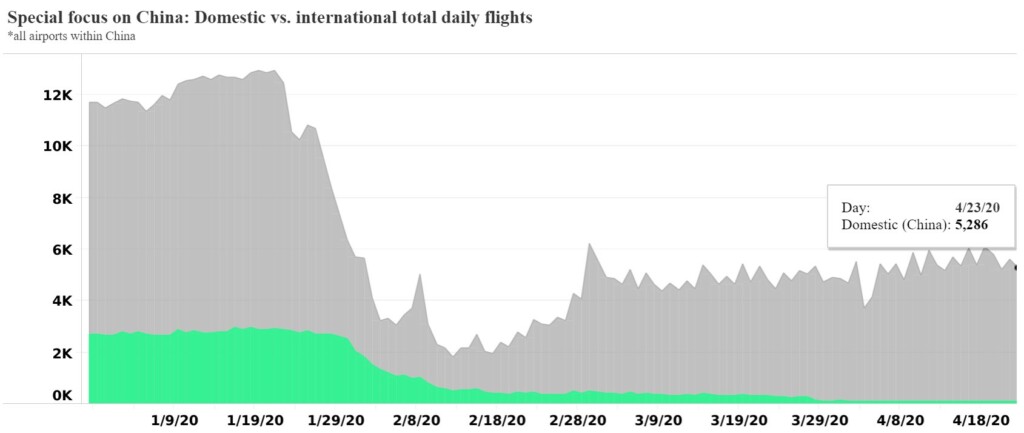

It’s expected that countries will gradually lift travel restrictions and domestic travel may be allowed first. Right now, in China, there are more than 5,000 daily domestic flights, while international flights are multiples less:

The example of Turkey shows that domestic tourism will return earlier than international travel. Turkish Airlines has drafted a flight plan and will resume domestic flights in June and gradually resume international flights during June, July, and August.

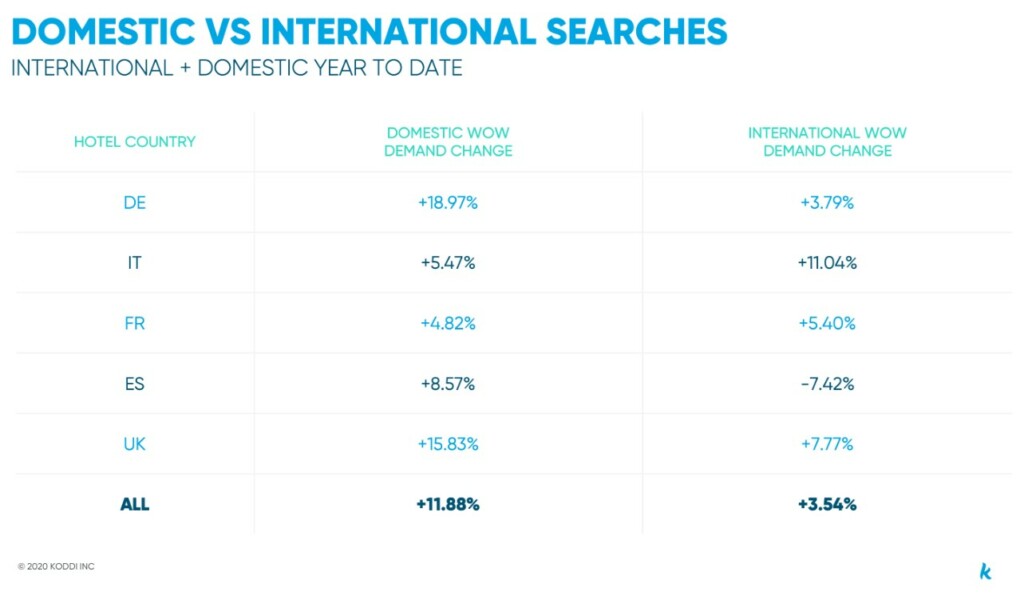

According to statistics on hotel reservations in the UK, France, Spain, Italy, and Germany, domestic tourism in Europe is also recovering faster than international tourism:

It may be some time before tourists are traveling the globe again. Domestic and regional tourism is one of the main trends in the post-coronavirus travel world and we described it in detail in the article below.

2. Booking Windows

In the face of uncertainty, it’s difficult for tourists to plan their trips in the same way as before, which affects booking windows. To help customers make purchases with fewer risks, travel companies have changed the terms of return or exchange. For example, United Airlines offers a flexible window on new and existing bookings until September 2020.

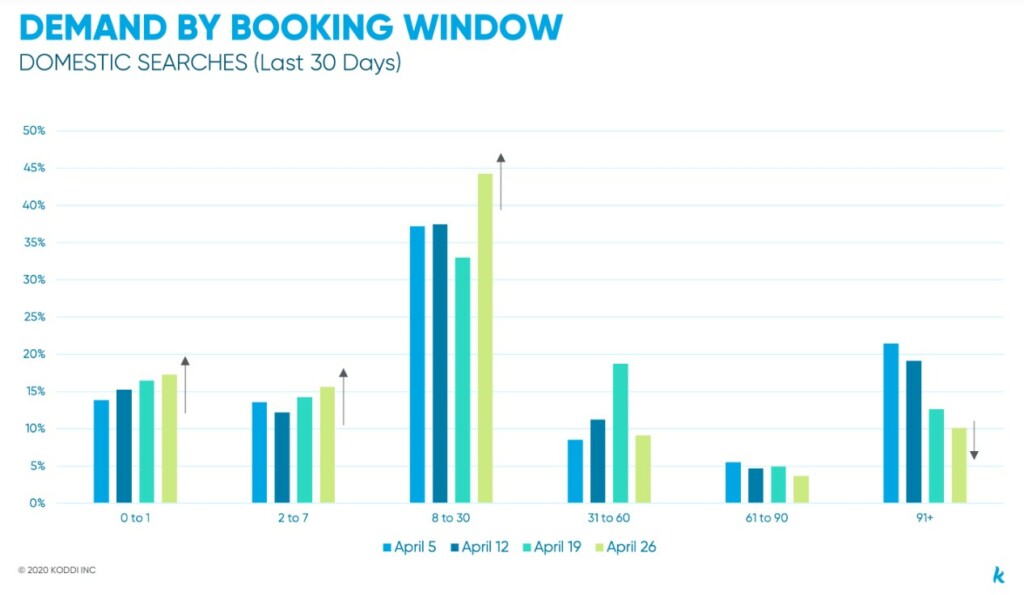

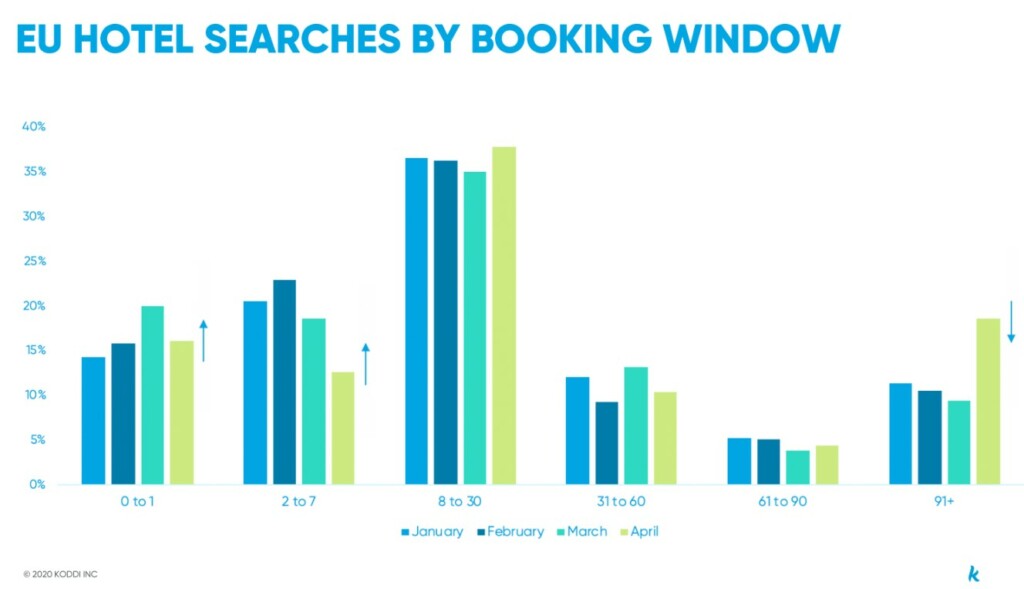

In April 2020, extremely short booking windows dominated. With gradual normalization, we in Europe faced booking window changes. The number of bookings within 2 to 30 days before the trip has grown, while the number of reservations with a booking window of more than 91 days falls every week:

According to the ADARA Traveler Trends Tracker, booking windows in the United States have also undergone a change:

- Domestic flights. The proportion has barely changed: advanced booking to 15 days for business trips and over 91 days for family trips are still widespread. In the meantime, the departure window for solo travelers and couples moved from 31 to 60 days to either advanced booking (up to 15 days) or over 91 days.

- Domestic hotels. For business travelers, advanced bookings up to 15 days are still the most popular, with other departure windows bringing similar volume. Family trips moved from advanced bookings to a departure window over 91 days, while solo travelers and couples booked hotels up to 15 days before departure.

You can also check data for EMEA, APAC, and China.

3. Travel Purpose

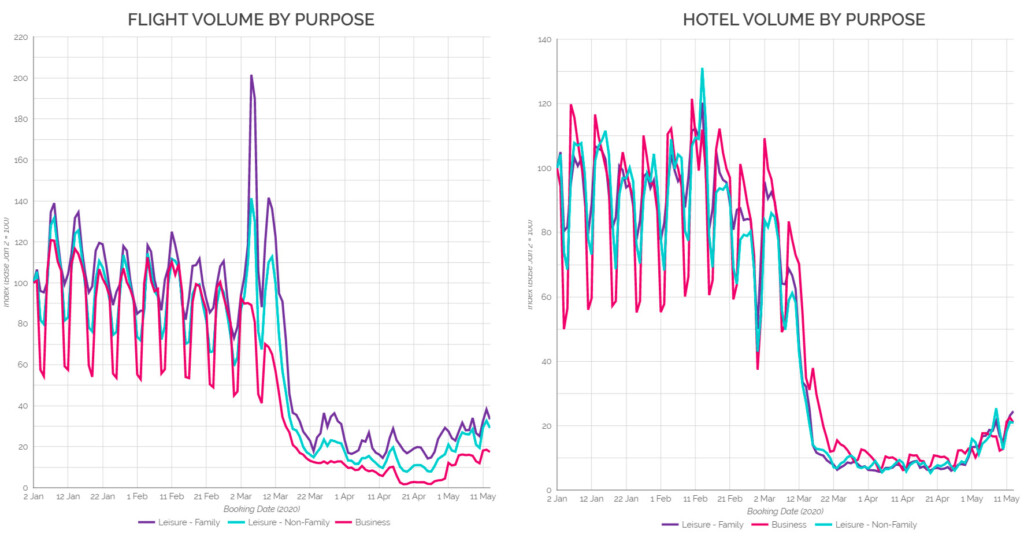

Family leisure still brings more flight bookings than solo tourists, couples, or business travelers. As for hotel stays, business travelers made more bookings than leisure tourists up until recently, but, as of May 4, 2020, the booking volume has been evenly distributed between all three. You can find more data from ADARA research below:

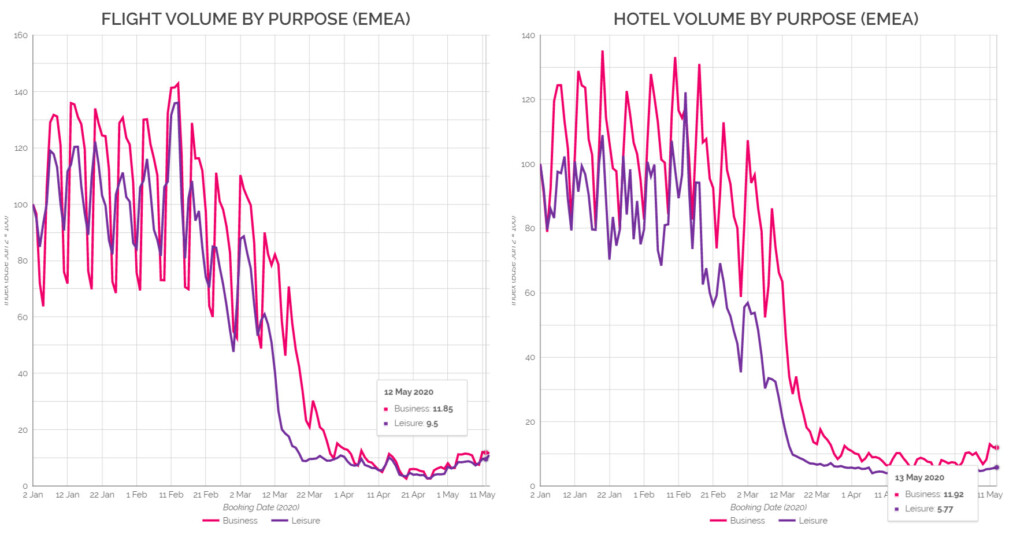

The ratio of travelers for leisure and business depends on the region. In EMEA, the situation is the opposite to the US, as more people fly for business purpose than for leisure:

You can follow the travel purposes in the constantly updated Adara report.

4. Mobility Trends

Since the emergence of COVID-19, travel has taken on a different nature. There has been a 93% decrease in the number of air passengers, ground transportation has also been largely reduced, and cruises have been cancelled, as people are cautious of crowded places. What transport modes will rebound the fastest once the COVID-19 pandemic is over?

Air travel is massively reduced and is expected to remain at less than 30% of last year’s capacity for the remainder of 2020, regaining its former level only by 2022.

Flights might first open up between safe corridors, such as Germany to Austria, for example. While some travelers canceled their vacation plans for at least six months, others are seeking low airfares for existing flights and are ready to travel as soon as the current restrictions are lifted.

Ground transportation has also experienced up to a 90% drop in major cities around the world, as people are being asked to avoid crowded places and maintain self-isolation. Operators have to comply with strict hygiene protocols, limit the number of passengers, and consistently check their health.

Private mobility may be on the rise over the long term, as travelers feel safer in privately owned vehicles and don’t want their trip to depend on flight cancellations. As a result, drive-to destinations will increase in popularity. The Longwoods survey showed that 22% of those who changed their vacation plans for this year switched their form of transportation to driving instead of flying.

Cruises will also become safer by introducing more procedures to control onboard illness and extend onboard medical capabilities.

5. Products

What kinds of products will see a surge in the coming months and years?

- Vacation rentals. For social distancing reasons, hotels and resorts are seeing a large decrease in bookings. Heightened guest turnover makes it hard for people to stay isolated and for hotel staff to disinfect rooms. Thus, private accommodations will find greater favor, as their owners are now enhancing safety measures, such as automatic locks, contactless food delivery, and space out rental periods. For example, the insurance company InsuranceMyTrip has already seen a 6% increase in vacation rentals in comparison to 2019, as well as drop in hotel bookings.

- Car rentals. As people are increasingly opting for close to home and drive-to destinations, demand for car rentals is expected to increase. Cars simultaneously allow travelers to stay isolated and move around as they please, thus more and more people will opt for driving over flying.

- Flexible bookings. To encourage people to book trips, companies around the world are introducing major changes to their policies, such as last-minute cancellations. Stronger demand is expected for the winter season, with reservations for Thanksgiving, Christmas, and New Year being up by 38%, 40%, and 23%, respectively, compared to 2019. This, naturally, will affect the budget allocations of travel companies, as they’ll need to be able to reimburse canceled bookings and preserve cash at all times.

- Travel insurance. Thanks to the rising health and safety concerns, travelers are increasingly aware of the importance of travel insurance. Up to 30% tourists are expected to buy travel insurance before hitting the road, say industry experts. Furthermore, some companies have upgraded their insurance policies and included “cancel for any reason” and medical evacuation options.

- Travel advisors. Canceling a trip and obtaining reimbursement has proven difficult and time-consuming, so travelers are now turning to the services of travel agents. Not only are agents able to help savvy tourists plan a trip and better navigate cancellation policies, but they also support travellers to reassess their personal finance and travel goals.

6. Types of Trips

According to industry experts, travelers are more likely to opt for these types of trips during the remainder of the year:

- Close to home trips and drive-to destinations.

- Multi-generation trips. Many families haven’t been able to meet up because of quarantine for a few months and travel agents are expecting multi-gen trips to rise significantly once travel is safe again.

- Longer trips. More and more travelers now prefer to book up to nine-day stays instead of the average three-and-a-half to five-day rental periods from before the pandemic.

- Vacations requiring advanced planning. Travel agents report a rise in vacations that require booking a year or more in advance. For example, African safaris, honeymoons, etc. People have been put on hold and want to have their dream vacation happen as soon as possible.

- Trips to remote places. Tourists will also be likely to open up to more isolated and less populated destinations. For example, traveling to a country with high population density, like India, will be more dangerous than travelling to Italy, for instance. Remote destinations like Africa should expect an increase in tourist inflow, according to Jessica Nabongo, founder of the travel firm Jet Black.

Domestic Tourism

Domestic and regional tourism is one of the potential solutions that will allow the world to maintain a low COVID-19 case count. Once the outbreak has ebbed, people will want to make up for their time at home and explore their available options.

Domestic tourism will resume first, followed by regional strategic partnerships, such as those within the Baltic countries, between Australia and New Zeeland, and among Czech Republic, Germany, and Austria, while international travel may still be a long way off. Travelers might want to stick close to home due to health concerns and lower income levels. For this reason, focusing on promoting domestic or regional tourism might be an excellent decision for webmasters right now.

Thus, find out where most of your audience is located and prepare travel advice for those regions. We’ve compiled the below list of popular tourist destinations and links to resources where you can find the most visited sights in each location.

You can take things a step further by dedicating an entire website to traveling in one region or country and preparing content in the native language of your audience.

For example, FranceVoyage.com is a comprehensive online guide for traveling around France. Readers can find all sorts of information, from travel activities and gastronomic advice to hotels and transportation.

Another great example of a website dedicated to regional travel is EspanaViajar. On this website, travelers can find advice on tourist sights, travel costs, gastronomic tips, and more.

How to Earn on Domestic Markets

Domestic tourism provides tourists with the same basic challenges as international travel:

- Where to stay (accommodations)

- How to get there (transportation)

- What to do (entertainment)

Therefore, you can continue to earn on various types of transportation, accommodations, and entertainment options. A significant difference in domestic tourism within small countries, such as the Czech Republic, is that people tend to use ground transportation instead of flights.

An attractive niche for earning in the domestic tourism field is car rentals. This is an individual form of transport, which allows the tourist to reduce the amount of interaction with other people, while providing maximum flexibility in travel planning.

To earn money on the domestic market, select the appropriate affiliate program. Ideally, look at the service through the eyes of your consumers and answer the following questions:

- How many offers are available for this specific route?

- Does the platform have a local language version?

- What brands are popular among the locals?

- Which payment methods are supported?

For example, if you previously worked with the Booking.com affiliate program for international travel, then for domestic tourism you can:

- Continue to work with the Booking.com affiliate program, as the service covers a large part of the world.

- Extend your offer with Hotels.com, for countries where this brand has more coverage and audience confidence.

To earn on the flights, hotels, car rentals and other travel services join the Travelpayouts affiliate network for free today.

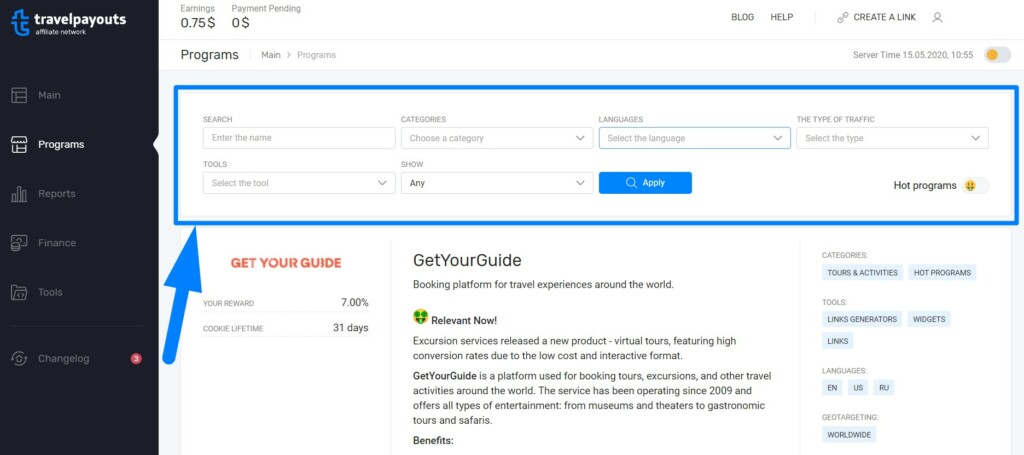

To find an affiliate program that suits your audience, use the dashboard filters:

Business Tourism

Business travelers will be among the first to move around once the restrictions have been lifted. For the economies to stay afloat, companies need to maintain and develop business relationships, which very often it implies staff meetings, site visits, conferences, trade fairs, and so on. Thus, you can take advantage of this trend and target business travelers on your blog.

Travel content that was previously targeted to leisure tourists isn’t suitable for business travelers. You need to prepare content and creatives for popular routes among business travellers.

Focus on large cities, industrial centers, and possible events. For example, previously large exhibitions, such as ITB in Berlin, created an increased demand for travel services.

To prepare suitable content, study the following key-points for business travelers:

- Almost 50% of business travelers choose a flight based on their schedule, however price plays an important factor as well.

- Workers frequently book hotels outside of the approved channels.

- European tech companies have unusual travel hubs: Stockholm, Amsterdam, Brighton, Copenhagen, and Lisbon are among their top destinations.

- 44% of European corporate travelers flew to visit with a customer, while 32% flew to visit another office in a different city.

- 50% of companies allow workers to book business travel using any method they choose. 59% of US business travelers always book their hotel themselves.

- 79% of corporate travelers have completed a business trip booking on their mobile device.

Don’t focus only on the business aspect. Business trips for conferences often become “bleisure” trips in which travelers combine work and rest. You can monetize your business traffic with the entertainment affiliate programs and other offers related to classical travelling.

Post-coronavirus World: Is It Still Possible to Earn in the Travel Niche?

Earning in the travel niche is possible even during the outbreak. For example, look into online excursions in the GetYourGuide affiliate program. Tourism is an integral part of modern society and, even though it’s temporarily impossible to travel, people will happily go on online excursions.

After the coronavirus, the travel industry is definitely expected to grow, which means there will be increases in income for affiliate marketers and travel-related businesses. How much you will earn depends on the dynamics of market recovery, as well as on your marketing strategy. Follow the trends, adapt your strategy, and be ready for the opening of the new frontier of the travel market.