Who Needs Accounting Software?

Accounting software are computer programs that help users keep comprehensive records and reports of a company’s financial transactions, which are important for the company’s proper management and tax payments.

Accounting tools may come in handy for all types of bloggers and online entrepreneurs, especially those who have e-commerce websites. Such programs will allow them to keep records of their incomes and expenditures as well as track the growth of their finances.

Best Accounting Software for Bloggers

Below are some of the best accounting software for bloggers that both aspiring and seasoned entrepreneurs may find useful.

#1. Akaunting

Akaunting is a free online accounting software that allows marketers to manage business finances, invoicing, and record all expenses accurately. Here are some of its key features:

- Use this comprehensive software for invoicing, expense tracking, and accounting for free

- Keep track of your financial records online (any day and anytime) via your PC or phone

- Share transactions and invoices with customers and accept payments

- Enjoy full data privacy with Open Source software

- Set up and use software in your native language (over 50 languages available)

#2. BrightBook

BrightBook is free accounting software that can be perfect for freelancers and small businesses. This program can also be an excellent alternative for other paid accounting software, due to the free solutions it offers for managing expenditures, invoices, and payments. Here are some distinguishing features of the BrightBook application software:

- Inventory tracking

- Access to unlimited users

- Multiple currency support to help create invoices for clients in various parts of the world

- Detailed functionality for audits, reviews, and compilations

- Create and customize invoices, statements, and quotes

- Send invoices directly to customers from the invoices page

- Financial planning, fixed asset management, and payroll services

However, keep in mind that BrightBook isn’t a full-service accounting software. It only provides you with a single financial statement. The tool also doesn’t have a dedicated invoices dashboard with outstanding invoices.

#3. CloudBooks

CloudBooks is a cloud-based invoicing system designed for small businesses to keep an appropriate record of time, invoices, and billings. By using CloudBooks’ applications, users can monetize billing hours spent on projects and ensure secure online payments for customers via credit cards, PayPal, or cash.

Here are some addition features of CloudBooks:

- Keep track of the amount of time spent on a project and compare it with the original time allocated for that project

- Manage project costs to easily add expenses to the invoice and project billing before sending it to the client

- View and track all project expenses

- Customize an expense method to suit your client’s needs with easy automation of tasks, especially when for recurring projects

- Stay informed on each client’s account statement and provide a detailed payment scheme

#4. FreshBooks

FreshBooks offers several invoicing features. As a result, this accounting software is best for online business owners who send a lot of invoices. In addition, this program helps users keep track of time and manage receipts.

A key advantage of FreshBooks is the variety of pricing plans, based on the number of clients you are actively working with. Below are some features of the FreshBooks accounting software:

- FreshBooks allows for the automation and customization of customers’ products and services

- Send recurring invoices and payment reminders as well as accept payments online via your PC or mobile app

- Diverse languages and currencies are supported, which is beneficial for international clients

- Keep track of billable time, records payments, and outstanding balances (if any)

- Connect other business programs to your FreshBooks that are helpful for analytic purposes, scheduling, marketing, etc.

#5. GnuCash

GnuCash is a free accounting software that can be downloaded and installed directly to your PC. This program cannot be accessed through a web browser. It is well suited for bloggers, freelancers, and small businesses.

GnuCash is a double-entry accounting software platform, meaning that every transaction carried out automatically debits an account and credits another account with the same amount.

Here are some features of the GnuCash accounting software:

- Record transactions in your checkbook-style register, including checking, income, stock, credit card, and currency transactions

- Customize transactions into expense and income account types, as well as the display and appearance of your register

- Only one user can be logged into the accounting software at once

- Users can access online self-service tools

- Compare a transaction carried out against a bank statement

- Financial data is represented on a bar graph, scatter plot, or pie chart

- Built-in and custom reports and charts

- VAT/GST reporting and tracking

- Home Banking Computer Interface (HBCI) support

#6. Wave Accounting

Wave Accounting software for small businesses is designed to help freelancers, bloggers, and online businesses streamline their bookkeeping process. It’s well suited for billing, receipt scanning management, payment tracking, invoicing, and credit card processing.

With this program, small businesses can develop reports to keep track of the success or growth of their business, such as balance sheets, sales tax, profits, losses, cash flow, etc. Below are some features:

- Create and send invoices, keep track of payment status, and receive notifications using the Wave invoicing mobile app

- Customize sales taxes and set up automatic payment reminders

- Accept bank and online credit card payments within invoices using WavePayments (users can also receive payments over the phone or in person)

- Automatically sync invoices and accounts

- Keep track of financial account statements and export accounting reports when necessary

- Integrate third-party apps, such as PayPal and Etsy

- Wave Accounting software is user-friendly (simple and easy to use)

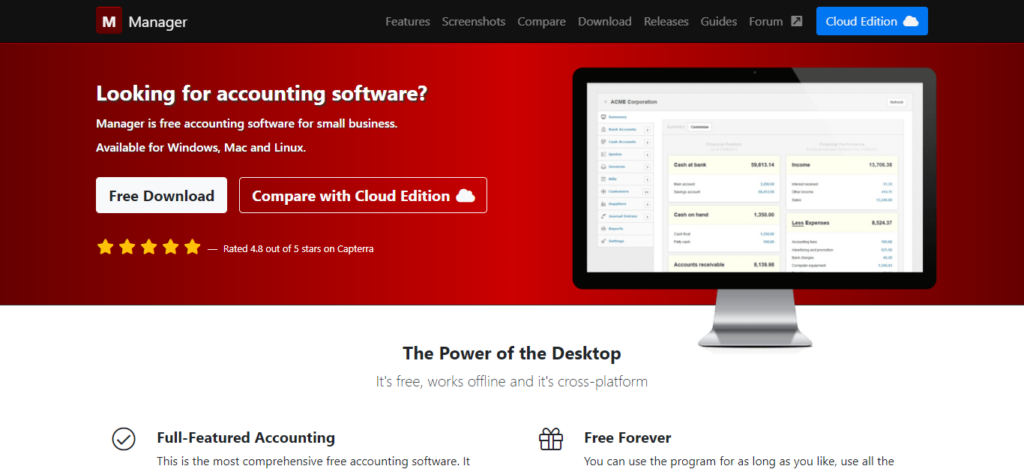

#7. Manager

Manager may just be the single best software for accountants. It supports multiple languages and diverse currencies. Accounting tasks don’t have to be a hassle anymore because Manager can provide an online mood for its users that helps them oversee their business operations even when there is no readily available internet connection. The setup process for this software is super easy and you don’t need a tutorial to begin.

Here are some of the features of the Manager accounting software:

- General ledger processing, cash management, remittance advice, etc.

- Automatic sending of recurring bills, customized invoices, and email templates

- No system checks (account labels cannot be changed)

- The ability to work offline if you can’t access a stable internet connection

- There are no restrictions on setting up your account and the software provides flexibility when setting up your account chart

- Access can be given to business partners on an as-needed basis, so they may complete required tasks without having access to other parts of the system (for example, a sales team can prepare or issue an invoice without access to additional relevant information on the system)

#8. Sunrise

Sunrise is a cloud software for accountants that is suitable for freelancers. This program features a bookkeeping option that helps users track expenses and create quotes, while simplifying the tax filing process. While the Sunrise accounting software can be used for free, it also has three paid plans for effective bookkeeping.

Here are some specific features of the Sunrise accounting software:

- Manage and record your expenses by keeping track of new bills, viewing past invoices, and taking note of unpaid bills

- Create invoices, send them to your clients, and receive payment

- Create multiple sales tax items that can be added to invoices

- Keep an excellent financial report system by keeping track of financial statements, profits, losses, tax reports, balance sheets, accounts payable, etc.

- Connect your bank accounts to Sunrise to transfer transactions into the program

- Choose between different payment plans

- Mobile applications are available for Android and iOS devices

#9. ZipBooks

ZipBooks is cloud-based accounting software and a payment process solution designed for freelancers, accountants, bloggers, and small business owners. All you have to do is log in to the ZipBooks website and link to your PayPal, Square, or Stride account to sync transactions and enable customers to pay their invoices automatically.

Make yourself familiar with the following features:

- Send professional invoices and customized emails to your customers, collect payments, and automate the billing process

- Effortlessly text clients from the app to streamline your communication

- Keep track of your expenses and maintain an up-to-date record (at a glance, you can quickly see what’s going on in your documents)

- Create tasks, track performance, and assign responsibility to team members with the project management feature

- Easily automate everything with recurring auto-bills and integrate your billing into your books

#10. Zoho Books

Zoho Books is an online business accounting software that helps small businesses manage their financial workflows, automate their operations, and ensure joint functionality across different departments.

Let’s take a look at some of the key features of the Zoho Books accounting software:

- Add your team members to enable them to log in, view reports, and manage the account

- Through the Zoho Book account software, you can create professional invoice logos, keep track of expenses, and send payment reminders to your customers

- Receive quick payment via transfers, cash, credit card, and cheques while setting up a recurring payment plan

- Upload documents, such as receipts and invoices, and automatically attach them to transaction records

- Zoho Sign integration provides you with the highest level of security (compliant with ESIGN and eIDAS e-signature laws)

How to choose the best accounting software

Accounting software can help businesses keep track of all their records and manage their finances wisely. It is essential to consider the cost of some of the best accounting software and the necessary features for your brand. In addition, consider the number of users that may need access to this software. Think about whether you prefer cloud-based or desktop programs. Finally, take advantage of the free trial of the software to test its functionality and make efficient investment later on.